How to Simplify Your Bills and Financial Commitments is a vital topic for anyone seeking to regain control over their financial landscape. In today’s fast-paced world, managing various bills and financial obligations can often feel overwhelming. Understanding the intricacies of your bills and commitments not only helps in maintaining a balanced budget but also enhances your financial wellness and peace of mind.

This guide will explore practical steps and effective strategies that can empower you to streamline your finances, analyze your current commitments, and adopt tools that will simplify your financial management. By following these insights, you will be equipped to navigate your financial responsibilities with confidence and clarity.

Understanding Your Bills

Understanding your bills is essential for managing personal finances effectively. Bills are a common aspect of everyday life, and comprehending them can significantly help individuals maintain their financial health. By familiarizing yourself with the various types of bills and financial commitments, you can develop strategies to streamline payments and avoid unnecessary expenses.There are several types of bills that individuals typically encounter, each with unique characteristics and payment schedules.

The primary categories include utility bills, healthcare bills, subscription services, loan payments, and credit card statements. Each of these bills can have varying due dates, amounts, and consequences for late payments, which can affect one’s overall budget. Beyond traditional bills, financial commitments such as student loans, car payments, and mortgages significantly impact your financial landscape.

Types of Bills and Financial Commitments

An understanding of the various types of bills and commitments helps in prioritizing payments and managing overall expenses. Here are some common types of bills that individuals often face:

- Utility Bills: Monthly charges for essential services such as electricity, water, gas, and internet.

- Healthcare Bills: Medical expenses including insurance premiums, co-pays, and out-of-pocket costs for treatments or medications.

- Subscription Services: Ongoing payments for services such as streaming platforms, gym memberships, or magazine subscriptions.

- Loan Payments: Monthly payments for personal, auto, or student loans that include interest and principal amounts.

- Credit Card Statements: Monthly reports detailing charges made on credit cards, including minimum payment due and interest charges.

Tracking bill due dates and amounts is crucial for effective financial management. Timely payments prevent late fees and potential damage to credit scores. Keeping an organized calendar or using financial management apps can significantly enhance your ability to track these commitments.

“Regularly monitoring bill due dates can save you from unnecessary fees and maintain your creditworthiness.”

Additionally, financial commitments often extend beyond the monthly bills. Regular obligations such as rent or mortgage payments require diligent budgeting. These commitments can consume a significant portion of your income and necessitate careful planning to ensure all expenses are covered without straining your financial resources. For example, an individual with a monthly income of $3,000 must allocate a substantial part of this towards fixed costs such as housing and transportation, thus limiting discretionary spending.Understanding the impact of these financial obligations on your budget is vital.

It not only aids in avoiding potential financial pitfalls but also empowers you to make informed decisions about spending, saving, and investing.

Analyzing Current Financial Commitments

Reviewing existing financial commitments is a crucial step in simplifying your bills and achieving better financial health. This process allows you to have a comprehensive overview of your financial obligations, ensuring that you can manage your budget effectively while prioritizing essential expenses.To analyze your current financial commitments, one must systematically review and categorize all existing bills and expenditures. This will help in identifying which expenses are necessary, which can be adjusted, and which may be eliminated entirely.

The following steps Artikel how to approach this analysis effectively.

Steps for Reviewing Existing Financial Commitments

Begin by gathering all financial documents, including bills, statements, and contracts. This collection ensures that you have a complete picture of your commitments. Once all documents are consolidated, follow these steps:

1. List All Bills and Commitments

Create a comprehensive list of every monthly and annual commitment, including utilities, rent or mortgage, insurance premiums, subscriptions, and loans.

2. Review Payment Terms

For each commitment, analyze the payment terms, due dates, and methods of payment. Knowing when payments are due can help in organizing finances more effectively.

3. Identify Total Amounts

Calculate the total amount for each commitment, including any associated fees or interest. This will provide insights into the overall financial impact of each bill on your budget.

4. Assess Timing and Frequency

Review whether the commitments are paid monthly, quarterly, or annually. Understanding the frequency of payments can help in budgeting for these expenses.

Categorizing Bills Based on Necessity and Frequency

Categorizing your bills is essential for effective financial management. By distinguishing between necessary and discretionary expenses, you can make informed choices about where to allocate your money. The following categories can be utilized:

Essential Bills

These are non-negotiable expenses that are necessary for daily living, such as:

Rent or mortgage payments

Utilities (electricity, water, gas)

Insurance (health, auto, home)

Discretionary Expenses

These include non-essential items that can be adjusted or eliminated, such as:

Subscription services (streaming, magazines)

Dining out and entertainment

To further refine your categorization, consider the frequency of each bill, as it can affect cash flow management.

Identifying Recurring Versus One-Time Expenses

Understanding the distinction between recurring and one-time expenses is vital in managing your finances effectively. Recurring expenses are those that occur on a regular basis, whereas one-time expenses are typically infrequent and irregular. To identify these expenses:

1. Review Your Bills

Go through your list and highlight bills that are paid regularly each month, such as subscriptions, utilities, and loan payments.

2. List One-Time Payments

Document any one-time purchases or expenses that occur throughout the year, such as home repairs, medical expenses, or holiday gifts.

3. Create a Financial Calendar

Use a calendar to track both recurring payments and anticipated one-time expenses. This can provide a clear view of your cash flow throughout the year.By analyzing your financial commitments through these steps, you can gain control over your spending, prioritize essential bills, and reduce unnecessary financial strain. This organized approach lays the groundwork for simplifying your bills and optimizing your financial commitments.

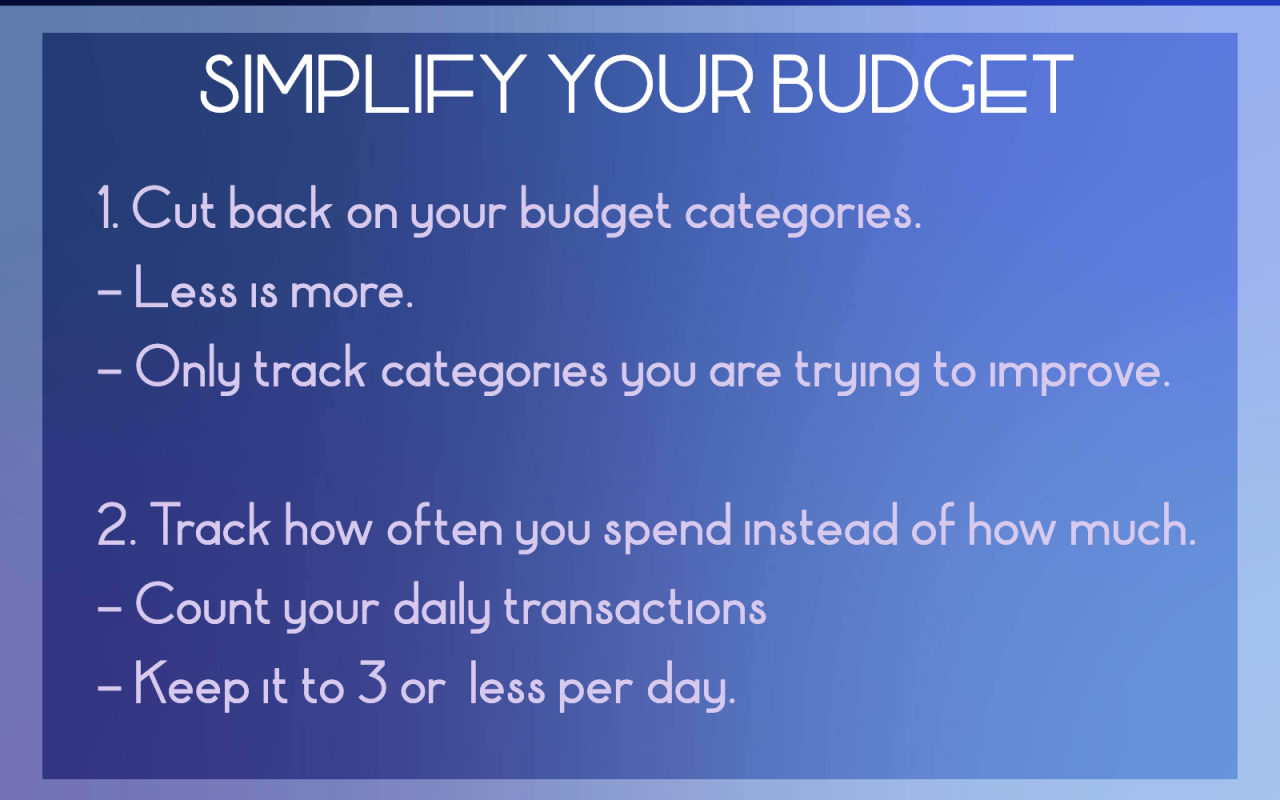

Creating a Simplified Budget

A simplified budget is essential for managing your finances effectively and ensuring that all bills and commitments are met without strain. By creating a structured budget, you can track your income and expenses, enabling you to make informed financial decisions that promote stability and reduce stress.Establishing a budget template allows you to visualize your financial commitments and allocate your funds appropriately.

This organized approach is crucial in distinguishing between fixed and variable expenses, which ultimately aids in managing your cash flow more effectively.

Designing a Budget Template

A budget template serves as a foundational tool to categorize your income and expenses. It is important to include all sources of income and every financial commitment to have a complete overview of your financial situation. The budget template can be structured as follows:

| Category | Details | Amount |

|---|---|---|

| Income | Salary, Freelance Work, Passive Income | $X,XXX |

| Fixed Expenses | Rent/Mortgage, Utilities, Insurance | $X,XXX |

| Variable Expenses | Groceries, Entertainment, Dining Out | $X,XXX |

| Savings | Emergency Fund, Retirement | $X,XXX |

| Debt Repayment | Credit Card, Loans | $X,XXX |

This template provides a clear and concise overview of your financial landscape, allowing you to identify potential areas for improvement.

Allocating Funds for Fixed and Variable Expenses

Proper allocation of funds is critical to maintaining financial health. Fixed expenses are predictable and typically remain constant, while variable expenses can fluctuate. To allocate funds effectively:

- Prioritize Fixed Expenses: Ensure that all fixed expenses are accounted for first, as they are essential for basic living and maintaining contractual obligations.

- Estimate Variable Expenses: Analyze past spending habits to forecast variable expenses accurately. Adjust these estimates based on seasonal fluctuations or life changes.

- Allocate Remaining Funds: After covering fixed and estimated variable expenses, allocate any remaining funds towards savings, debt repayment, or discretionary spending.

By following this allocation strategy, you can ensure that your essential obligations are met while also taking steps toward financial growth.

Organizing a Priority List for Bill Payments

Creating a priority list for bill payments is a vital step in avoiding late fees and maintaining a good credit score. This organization ensures that you know which bills must be prioritized based on their due dates and consequences of late payment.Consider the following points to establish a priority list:

- Due Dates: List all bills in chronological order of their due dates to ensure timely payments.

- Consequences of Late Payment: Identify which bills incur late fees or penalties and prioritize them accordingly.

- Essential Services: Prioritize payments for essential services such as utilities and housing to maintain necessary living conditions.

- Flexible Payments: Some payments can be delayed without severe consequences, allowing you to focus on more urgent commitments first.

By organizing your bill payments in this manner, you can avoid unnecessary penalties and maintain financial stability.

Automating Bill Payments

Setting up automatic payments can greatly enhance your financial management by ensuring that your bills are paid on time without the need for manual intervention. This not only saves you time but also helps you avoid potential late fees. The convenience of automation allows you to focus on other important aspects of your financial life while maintaining a clear record of your commitments.Establishing automated payments can significantly streamline the management of your recurring bills.

Many financial institutions and service providers offer tools that facilitate this process, helping you to set up regular payments with minimal effort. By using these services, you can efficiently manage your cash flow and gain peace of mind knowing that your obligations are met promptly.

Benefits of Automatic Payments

Automating your bill payments offers numerous advantages, making it a valuable strategy for effective financial management. Key benefits include:

- Timeliness: Automated payments ensure that your bills are paid on time, reducing the risk of late fees and negative impacts on your credit score.

- Convenience: With automation, you can eliminate the need for manual payments each month, freeing up time for other priorities.

- Budgeting Accuracy: Regular automated payments help in tracking your expenses and can be easily incorporated into your budgeting processes.

- Reduced Stress: Knowing that your bills are taken care of can minimize anxiety and enhance your overall financial well-being.

Services for Managing Recurring Bills

Several services exist that can assist you in managing your recurring bills effectively. Utilizing these tools can enhance your ability to automate payments while offering additional features for tracking and monitoring your financial commitments. Notable options include:

- Your Bank’s Bill Pay Service: Many banks provide built-in bill pay features that allow you to set up recurring payments directly from your account.

- Third-Party Payment Apps: Apps such as Mint, Prism, or Truebill can help you manage your bills and automate payments while providing insights into your spending habits.

- Utility Provider Services: Many utility companies offer their own automated payment options, allowing you to set up direct payments from your bank account.

Monitoring Automated Payments

While automating your payments offers great convenience, it is essential to regularly monitor these transactions to prevent errors and ensure accuracy. Implementing a few guidelines can help maintain oversight over your automated commitments:

- Regular Account Reviews: Schedule periodic reviews of your bank statements to verify that all automated payments are processed correctly.

- Set Payment Alerts: Utilize notifications from your bank or payment service to receive alerts on due dates and successful transactions.

- Update Payment Information Promptly: Ensure that you update your payment details immediately if there are changes in your banking information or service providers.

- Check for Unrecognized Charges: Be vigilant for any unauthorized or unexpected charges in your automated payments, and address them promptly.

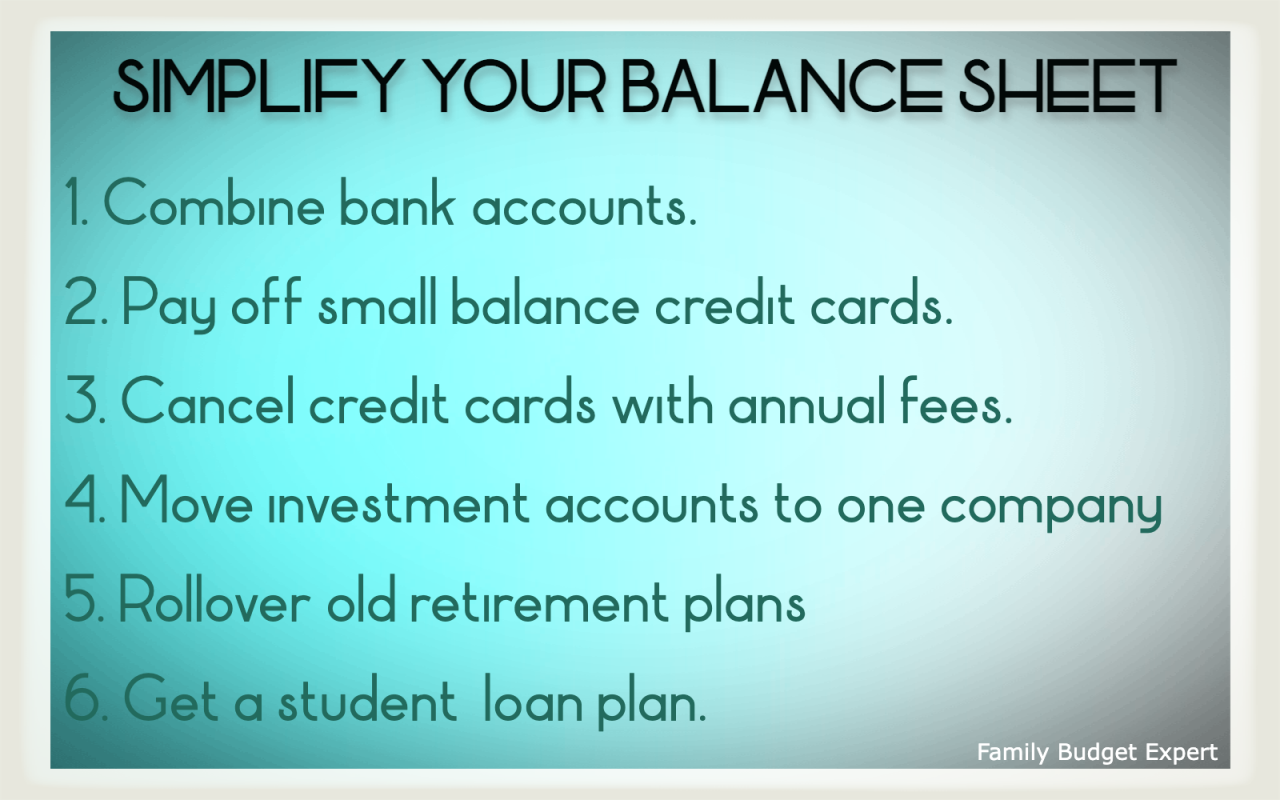

Consolidating Financial Commitments

Consolidating financial commitments can be a significant step toward achieving better financial management. This process not only streamlines payments but also can lead to potential savings. By bringing multiple obligations together, individuals can simplify their financial landscape and focus on managing fewer payments effectively.One of the primary strategies for consolidation involves merging various bills and loans into a single payment.

This can be particularly advantageous for consumers juggling multiple credit cards, loans, or bills that each have different payment due dates. By consolidating these into fewer payments, individuals can reduce the chances of missing payments and incurring late fees.

Strategies for Consolidating Bills

When considering consolidation, several methods can be employed to make the process more effective. The following strategies can assist in merging financial commitments into fewer payments:

- Debt Consolidation Loans: These loans allow consumers to combine multiple debts into one single loan, often with a lower interest rate. This reduces the number of payments and may lower monthly obligations.

- Balance Transfer Credit Cards: Transferring high-interest credit card balances to a single credit card with a lower interest rate can simplify payments and reduce costs over time.

- Utility Bill Consolidation Services: Some companies offer services to bundle multiple utility bills into one payment, making it easier to manage monthly expenses.

- Loan Refinancing: Refinancing existing loans can allow for better rates and terms, which may facilitate a more manageable payment structure.

Negotiating Terms with Creditors

Negotiating with creditors can lead to improved rates and terms, further easing financial burdens. Effective negotiation can result in lower interest rates, reduced fees, or even more favorable payment plans. Here are some essential steps to consider when approaching creditors:

- Prepare documentation that Artikels your current financial situation, including income, expenses, and outstanding debts.

- Research comparable interest rates and terms from other lenders to strengthen your negotiation position.

- Communicate openly with creditors about your financial goals and challenges, expressing your desire to find a mutually beneficial solution.

- Consider requesting a temporary forbearance or restructuring of payments if you are experiencing financial difficulties.

Refinancing Options for Existing Loans

Refinancing existing loans can be a practical way to consolidate financial commitments and potentially save on interest costs. Various refinancing options are available, depending on the type of loan:

- Mortgage Refinancing: Homeowners can refinance their existing mortgages to secure lower interest rates or alter the loan terms, resulting in lower monthly payments.

- Student Loan Refinancing: This option allows borrowers to combine federal and private student loans into a single loan with potentially lower interest rates.

- Auto Loan Refinancing: By refinancing an auto loan, individuals can take advantage of better interest rates, thereby reducing monthly payments and overall loan costs.

“Consolidating financial commitments not only streamlines your payments but also enhances your budgeting capabilities.”

Utilizing Financial Management Tools

Utilizing financial management tools can greatly enhance your ability to simplify your bills and manage financial commitments effectively. These tools offer a variety of features that can streamline your budgeting process, automate payments, and provide valuable insights into your spending habits. By leveraging technology, you can take control of your finances and ensure that you are meeting your financial goals with ease.

Features to Look for in Financial Management Applications

When selecting a financial management application, it is essential to consider specific features that can significantly impact your financial organization. The right app should facilitate better oversight of your bills and commitments. Key features include:

- Bill Tracking: Look for tools that allow you to track due dates and amounts for various bills, helping you avoid late fees.

- Budgeting Capabilities: The app should enable you to create and manage budgets tailored to your financial situation.

- Expense Categorization: A feature that categorizes your spending can help you identify areas where you can reduce expenses.

- Automated Reminders: Notifications for upcoming payments ensure you stay informed and avoid missed deadlines.

- Reports and Insights: Analytic tools that provide visual representations of your spending patterns and overall financial health are valuable for making informed decisions.

Comparison of Popular Tools for Bill Management

Choosing the right financial management tool can be overwhelming due to the myriad of options available in the market. Here is a comparison of some popular tools that can effectively simplify your bill management:

| Tool | Key Features | Cost |

|---|---|---|

| Mint | Free bill tracking, budgeting, expense categorization, and alerts | Free |

| You Need A Budget (YNAB) | Proactive budgeting approach, detailed reporting, and goal setting | $11.99/month or $84/year |

| EveryDollar | Simple budgeting interface, expense tracking, and customizable categories | Free with optional paid features |

| Personal Capital | Investment tracking, retirement planning tools, and net worth calculation | Free; advisory services available at a fee |

These tools offer a range of functionalities designed to assist with financial management. By evaluating your individual needs, you can select the most suitable option.

Importance of Regularly Updating Financial Tools and Apps

Maintaining up-to-date financial management tools is crucial for optimal performance and security. Regular updates ensure that applications stay secure against cyber threats and incorporate the latest features that may improve user experience. Additionally, financial tools often enhance their algorithms for better expense categorization and budgeting suggestions, making it vital to keep them current.

“Regular updates to your financial management applications not only protect your sensitive data but also enhance the overall functionality, allowing for better financial decision-making.”

Furthermore, updating your tools can help you take advantage of new integrations with banks and payment services, making it easier to manage your finances seamlessly. As financial technology evolves, being proactive about updates can lead to more efficient bill management and a clearer understanding of your financial commitments.

Reviewing and Adjusting Commitments Periodically

Regularly reviewing your financial commitments is essential for maintaining control over your financial health. The landscape of personal finance can change due to various factors such as income fluctuations, changes in expenses, or shifting financial goals. By conducting periodic reviews, you can ensure that your budget remains aligned with your current situation, ultimately leading to a more secure financial future.Establishing a consistent schedule for reassessing bills and expenses is crucial.

A well-structured approach not only simplifies the process but also enhances your ability to manage finances effectively. Generally, it is advisable to conduct a comprehensive review of your financial commitments at least once every three to six months. This timeframe allows for timely adjustments in response to any significant changes in your financial landscape.

Importance of Adapting Budgets to Changing Financial Situations

As life circumstances evolve, it is vital to adapt your budget accordingly to avoid financial strain. Maintaining a flexible budget enables you to accommodate unexpected expenses, such as medical emergencies or car repairs, without derailing your overall financial plan.Consider the following factors when revisiting your budget:

- Income Changes: If you receive a raise or experience a job loss, your budget should reflect these shifts. For instance, a newly acquired income stream can allow for additional investments or savings, while a decrease may necessitate spending cuts.

- Expense Adjustments: Regularly examine your fixed and variable expenses. Identify areas where costs can be reduced, such as renegotiating bills or canceling unused subscriptions. For example, if you find that you are frequently using a gym membership, but not attending regularly, it may be prudent to cancel that subscription.

- Financial Goals: As your financial objectives evolve, whether saving for a home or planning for retirement, your budget should be adjusted to ensure you are on track to meet these goals. When financial priorities shift, reassessing your budget helps in redirecting funds where they are most needed.

- Market Changes: Economic conditions can influence your financial commitments. For instance, changes in interest rates may affect loan repayments. Staying informed about market trends and adjusting your commitments accordingly can aid in financial stability.

“Flexibility in budgeting is key to navigating the unpredictable nature of personal finances.”

By regularly reviewing and adjusting your financial commitments, you position yourself to navigate life’s financial challenges with greater ease, ensuring continued progress toward your financial goals.

Seeking Professional Financial Advice

In today’s complex financial landscape, seeking professional financial advice can be a pivotal step towards achieving lasting financial stability and confidence. While many individuals manage their finances independently, there are specific scenarios where the expertise of a financial advisor can be invaluable. Understanding when to consider this option can lead to more informed financial decisions and better outcomes.Various circumstances may prompt the need to hire a financial advisor.

Individuals facing significant life changes, such as marriage, divorce, or the birth of a child, often find themselves needing guidance to navigate the financial implications of these events. Additionally, those approaching retirement or those who have inherited a substantial amount of money may also benefit from professional advice to manage their new financial realities effectively.

Benefits of Consulting with Financial Professionals

Consulting with financial professionals can provide numerous advantages, particularly in complex situations where specialized knowledge is required. The following points Artikel the key benefits of engaging a financial advisor:

-

Expertise in Diverse Financial Areas:

Advisors possess in-depth knowledge of various financial sectors, including investments, taxes, and retirement planning. This expertise allows them to offer tailored solutions that align with individual financial goals.

-

Objective Perspective:

A financial advisor can provide an unbiased viewpoint on financial matters, helping clients to make rational decisions rather than emotional ones during times of financial uncertainty.

-

Time-Saving:

Managing finances can be time-consuming. Financial advisors take on the burden of research, planning, and execution, freeing clients to focus on their personal and professional lives.

-

Customized Financial Strategies:

Advisors develop personalized financial strategies that consider a client’s unique circumstances, ensuring that all aspects of their financial life are addressed cohesively.

-

Access to Resources:

Many financial advisors have access to exclusive investment opportunities and financial products that may not be available to the average consumer, potentially enhancing clients’ portfolios.

Finding a Qualified Financial Advisor

Choosing the right financial advisor can significantly impact the effectiveness of the advice received. To ensure a successful partnership, consider the following tips for finding a qualified professional in your area:When searching for a financial advisor, it is essential to establish trust and verify credentials. Look for advisors who hold recognized certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

These designations indicate a commitment to ethical practices and a level of expertise in financial planning.Engage in thorough research by utilizing online platforms that offer reviews and ratings of financial advisors. Additionally, personal referrals from friends, family, or colleagues can provide insight into the advisor’s capabilities and reliability. Finally, schedule consultations with potential advisors to discuss your financial situation and gauge their communication style and expertise.

This initial meeting is an opportunity to evaluate their understanding of your unique needs and their approach to financial planning.

Ending Remarks

In conclusion, simplifying your bills and financial commitments is not just about reducing expenses; it’s about fostering a stable financial future. By implementing the strategies discussed, such as creating a simplified budget, automating payments, and reviewing your commitments regularly, you can significantly enhance your financial situation. Remember, the key to effective financial management lies in staying organized and proactive, ensuring that your financial commitments work for you, not against you.