Beginning with How to Apply Minimalist Principles to Your Finances, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

In today’s fast-paced world, financial clutter can often overwhelm individuals, leading to stress and poor decision-making. By embracing minimalist principles, one can simplify their financial life, focusing on what truly matters and eliminating distractions. This approach not only enhances financial clarity but also promotes a sense of peace and control over personal finances.

Understanding Minimalism in Finance

Minimalism is often perceived as a lifestyle choice focused on decluttering and simplifying one’s possessions. However, its principles extend far beyond the physical realm and can significantly influence financial management. By embracing minimalism in finances, individuals can streamline their spending, prioritize meaningful expenditures, and foster a healthier relationship with money.The core principles of minimalism in finance revolve around intentionality, simplicity, and clarity.

These principles encourage individuals to evaluate their financial choices critically and distinguish between needs and wants. This approach allows for a more mindful allocation of resources, which can lead to greater satisfaction and reduced financial stress. Adopting a minimalist mindset can also uncover the benefits of prioritizing quality over quantity, leading to more meaningful investments in one’s lifestyle and future.

Benefits of Adopting Minimalism in Personal Finances

Implementing minimalist principles in personal finances offers numerous advantages that can significantly enhance financial well-being. These benefits include:

- Increased Financial Clarity: Minimalism promotes transparency in financial matters, helping individuals understand their spending patterns and financial goals more clearly.

- Reduced Financial Stress: By simplifying financial commitments and focusing on essential expenses, individuals often experience lower levels of anxiety related to money management.

- Improved Savings: A minimalist approach encourages the redirection of funds from unnecessary purchases towards savings or investments, facilitating long-term financial security.

- Enhanced Focus on Financial Goals: Minimalism helps individuals concentrate on what truly matters, allowing them to prioritize and achieve their financial objectives more effectively.

Common Misconceptions about Minimalism and Finances

Despite the growing interest in minimalism, several misconceptions persist regarding its application to finances. These misconceptions can hinder individuals from fully embracing a minimalist approach. Understanding these myths is essential for fostering a proper mindset towards financial minimalism.

- Minimalism Means Living a Life of Deprivation: Many believe that minimalism entails sacrificing all luxuries. In reality, it is about making intentional choices that align with one’s values and priorities, allowing for enjoyment of meaningful experiences.

- Minimalism is Only for the Wealthy: Some think that minimalism is impractical for those with limited finances. However, minimalism can be beneficial at any income level by helping individuals manage their resources more effectively.

- Minimalism is a One-Size-Fits-All Solution: Individuals often overlook that minimalism is a personal journey. What works for one person may not work for another, and the minimalist approach should be tailored to individual circumstances and goals.

Evaluating Current Financial Situation

Assessing your current financial situation is a fundamental step in applying minimalist principles to your finances. By understanding your financial habits and expenditures, you can identify areas for improvement, ultimately leading to a more simplified financial life. This evaluation allows you to make informed decisions about where to allocate your resources efficiently.Tracking income and expenses is essential for gaining a clear picture of your financial landscape.

A systematic approach enables you to recognize spending patterns and make necessary adjustments. The following steps Artikel an effective method for assessing your financial habits.

Method for Assessing Financial Habits and Expenditures

To evaluate your current financial situation accurately, it is crucial to track your income and expenses diligently. The following steps provide a structured method to assist you in this process:

1. Gather Financial Documents

Collect all relevant financial statements including bank statements, credit card bills, and pay stubs. This information will serve as the foundation for your assessment.

2. Create an Income Overview

List all sources of income, including salary, bonuses, rental income, and any side business earnings. This overview provides a snapshot of your total cash inflow.

3. Track Daily Expenses

Maintain a daily log of all expenditures, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out) costs. This practice helps to reveal spending patterns.

4. Calculate Monthly Totals

At the end of each month, sum up your total income and total expenses. This will highlight whether you are living within your means or exceeding your budget.

5. Identify Trends

Review the logged data to identify consistent trends or unexpected spikes in spending. This analysis can inform future financial decisions.

Categorizing Financial Commitments

Once you have a clear understanding of your income and expenses, categorizing your financial commitments into essential and non-essential items is vital. This distinction allows you to prioritize spending and identify areas where you can cut back. Begin by creating two categories: essential and non-essential. Essential commitments include necessary living expenses, while non-essential items comprise discretionary spending. Consider the following points to help with this categorization:

Essential Expenses

These are non-negotiable costs necessary for your basic needs and overall well-being. Examples include housing (rent/mortgage), utilities, groceries, and transportation.

Non-Essential Expenses

These expenses can be classified as luxurious or discretionary. Examples include dining out, subscription services, and entertainment costs.

“Understanding the difference between essential and non-essential expenses is key to implementing minimalist principles in your financial life.”

By evaluating your financial situation and categorizing your commitments, you can create a streamlined budget that reflects your minimalist financial goals. This approach not only simplifies your financial management but also aligns your spending with your values, promoting a more meaningful and focused financial existence.

Simplifying Financial Goals

In the pursuit of a minimalist lifestyle, simplifying financial goals is crucial for aligning with one’s values and priorities. A framework designed to foster clarity and focus can aid individuals in establishing meaningful financial objectives. By eliminating distractions and unnecessary complexities, one can streamline efforts towards achieving financial well-being.Creating a framework for setting minimalist financial goals involves a few key steps.

Firstly, it is essential to identify core values that resonate with personal aspirations. Secondly, goals should be articulated clearly and concisely, avoiding vague language. Finally, establishing measurable criteria will help track progress effectively. This framework not only simplifies the goal-setting process but also makes it more intentional and aligned with minimalist principles.

Prioritizing Financial Goals

Prioritizing financial goals is fundamental in the minimalist approach to personal finance. When financial objectives are clearly defined, it becomes easier to allocate resources efficiently and minimize distractions. By focusing on a limited number of essential goals, individuals can ensure that their efforts yield meaningful results.To illustrate the importance of prioritizing financial goals, consider the following examples of short-term and long-term objectives that reflect minimalism:Short-term financial goals:

- Establishing an emergency savings fund of three to six months’ worth of living expenses.

- Paying off high-interest debt within a specified timeframe, such as one year.

- Reducing discretionary spending by 30% to free up funds for essential needs.

Long-term financial goals:

- Saving for a down payment on a modest home that fits within a budget aligned with personal values.

- Investing in a retirement plan that emphasizes sustainable and responsible options.

- Building a passive income stream through minimalistic investments, such as index funds or real estate, that require less active management.

Establishing these goals not only provides a roadmap for financial decisions but also reinforces the minimalist philosophy of doing more with less. By focusing efforts on what’s truly important, individuals can experience a greater sense of fulfillment and financial stability.

Budgeting the Minimalist Way

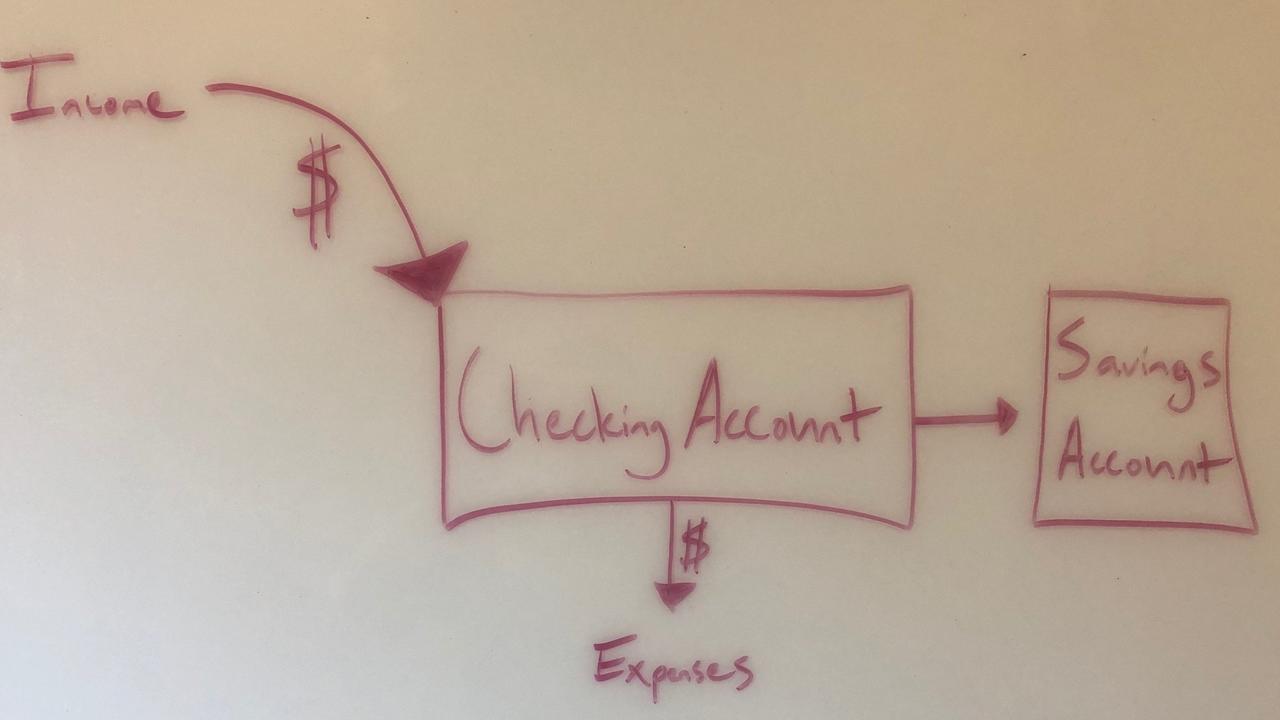

Creating a minimalist budget involves streamlining financial commitments to reduce clutter and enhance clarity. A well-designed budget not only tracks income and expenses but also aligns with the overarching principle of minimalism—prioritizing what truly matters. By adopting a minimalist approach to budgeting, individuals can foster better financial habits and focus on their essential needs.One effective method for constructing a minimalist budget is the envelope system, where cash is allocated into envelopes designated for specific spending categories.

This method encourages mindful spending and helps prevent overspending. Additionally, utilizing digital tools that resonate with minimalist principles can further simplify budgeting processes. Minimalist budgeting apps and clear spreadsheets can assist users in visualizing their financial landscape without overwhelming them with excessive information.

Creating a Minimalist Budget

To craft a minimalist budget, it is crucial to start with a clear understanding of income and necessary expenses. The following steps can be beneficial in developing a straightforward and effective budget:

1. Identify Essential Expenses

List all necessary monthly expenses, including housing, utilities, groceries, and transportation. Distinguishing between needs and wants is vital to ensure that the budget reflects genuine priorities.

2. Track Income

Calculate total monthly income from all sources. This includes salaries, side jobs, and any passive income streams. Understanding total income provides a foundation for budgeting.

3. Set Spending Limits

For each essential category, establish reasonable spending limits based on historical data and realistic expectations. This limits the potential for financial clutter and encourages mindful expenditure.

4. Incorporate Savings

Allocate a portion of the budget toward savings or investments. Minimalism emphasizes the importance of financial security, making savings a fundamental aspect of any budget.

5. Review and Adjust Regularly

Establish a routine for reviewing the budget, ideally on a monthly basis. This involves analyzing whether spending aligns with set limits and making necessary adjustments to stay on track.To facilitate the budgeting process, several tools can be employed that align with minimalist principles. These tools are designed to simplify financial management and promote clarity.

Minimalist Budgeting Tools

Choosing the right budgeting tools can significantly enhance the minimalist budgeting experience. Simple and intuitive apps, as well as straightforward spreadsheets, can streamline financial management. Here are a few suggestions:

Budgeting Apps

Tools such as YNAB (You Need A Budget) or Mint provide user-friendly interfaces that allow individuals to create budgets without overwhelming features. These apps often enable users to categorize expenses and track spending against budgeted amounts in real-time.

Spreadsheets

A minimalist spreadsheet can be customized to track income and expenses clearly. Templates can be designed to show only necessary information, avoiding clutter while still providing crucial financial insights.

Pen and Paper

For those who prefer a tangible approach, a simple notebook can serve as an effective budgeting tool. Writing down expenses and income helps with retention and mindfulness about spending habits.Regular reviews of the budget are essential for maintaining a minimalist approach, ensuring financial clarity and adaptability.

Reviewing and Adjusting Budgets

Conducting regular reviews of the budget is vital for ensuring financial health and adherence to minimalist principles. The review process should be straightforward, focusing on key metrics that allow for clear insights into spending patterns and areas for improvement.

1. Monthly Review Sessions

Set aside time each month to assess actual spending against the budgeted amounts. This process highlights discrepancies and helps reinforce financial discipline.

2. Track Changes in Income or Expenses

Any significant changes in income or unexpected expenses should prompt a budget review. Adapting the budget accordingly ensures it remains aligned with current financial realities.

3. Adjust Goals as Necessary

As financial situations evolve, goals may need to be recalibrated. Whether aiming to save more or adjust spending limits, flexibility is key to maintaining a minimalist budget.

4. Reflect on Financial Behavior

Take time to reflect on financial habits and identify patterns that may warrant change. This self-reflection fosters a deeper understanding of spending motivations and can lead to healthier financial choices.In summary, budgeting the minimalist way allows individuals to prioritize essential expenses, utilize efficient tools, and maintain a regular review process. By focusing on what truly matters, financial clutter can be reduced, leading to a more empowered and intentional approach to personal finances.

Reducing Debt through Minimalism

Embracing minimalist principles can significantly alter the approach to managing debt. By focusing on essential needs and eliminating excess, individuals can prioritize debt repayment and cultivate healthier financial habits. This section will explore strategies for reducing debt through minimalism, emphasizing the importance of intentional spending and clear financial goals.

Strategies for Prioritizing Debt Repayment

Effective debt repayment requires a well-structured plan that aligns with minimalist values. The following strategies can help prioritize and manage debt more efficiently:

1. Identify Non-Essential Expenses

Review monthly expenses to determine which items are unnecessary. Eliminate or reduce these expenditures to free up funds for debt repayment.

2. Create a Debt Repayment Plan

List all debts, including interest rates and minimum payments. Prioritize debts based on either the highest interest rates (avalanche method) or the smallest balances (snowball method) to maintain motivation and focus.

3. Set Clear Financial Goals

Define specific, measurable, and achievable financial goals related to debt reduction. For instance, aim to pay off a certain debt within a specified timeframe, which fosters accountability.

4. Automate Payments

Automating debt payments can prevent late fees and ensure that minimum payments are consistently made. This approach simplifies financial management and reduces the risk of falling behind.

5. Minimize New Debt

Commit to not incurring additional debt while focusing on repayment. This can be achieved by avoiding impulse purchases and reassessing the necessity of credit card use.

“Intentional living leads to intentional spending, which is vital in reducing debt.”

Impact of Minimalism on Spending Habits

Adopting a minimalist lifestyle can lead to significant changes in spending habits that contribute to debt accumulation. By becoming mindful of spending patterns, individuals can foster healthier financial behaviors. Key impacts include:

Enhanced Awareness of Needs vs. Wants

Minimalism encourages individuals to differentiate between essential needs and superficial wants. This awareness can significantly reduce unnecessary purchases.

Focus on Experiences Over Material Goods

Minimalists often prioritize experiences, such as travel or time spent with loved ones, over acquiring material possessions. This shift in focus can lead to fewer purchases that contribute to debt.

Reduced Impulse Buying

By adopting a minimalist mindset, the tendency for impulse purchases diminishes. This reduction in spontaneous spending is crucial in managing debt effectively.

Step-by-Step Plan to Eliminate Non-Essential Debt

Eliminating non-essential debt requires a systematic approach that incorporates minimalist principles. The following step-by-step plan Artikels an effective method:

1. Assess Your Debt

Create a comprehensive list of all debts, noting balances, interest rates, and due dates. Understanding the complete financial picture is vital for making informed decisions.

2. Evaluate Your Financial Situation

Analyze your income and expenses to identify areas where costs can be minimized. This should include a thorough review of subscription services, dining out, and other discretionary spending.

3. Establish a Realistic Budget

Develop a budget that prioritizes essential living expenses and debt repayments. Allocate any surplus funds towards paying off debts, focusing on higher interest loans first.

4. Implement the Debt Payment Strategy

Choose either the avalanche or snowball method for debt repayment. Commit to making extra payments on prioritized debts, consistently contributing more than the minimum required.

5. Track Progress and Adjust as Necessary

Regularly monitor debt repayment progress and make adjustments to the budget as needed. Celebrate small victories to stay motivated on the journey to becoming debt-free.By applying minimalist principles to finances, individuals can effectively reduce their debt burden, cultivate sustainable spending habits, and achieve long-term financial stability.

Investing with Minimalism in Mind

Investing through a minimalist lens requires a fundamental shift in how one approaches financial growth. While traditional investing often emphasizes a diverse portfolio filled with numerous assets, minimalist investing champions simplicity, intentionality, and clarity. This approach prioritizes quality over quantity, focusing on select investments that align with one’s values and financial goals.Minimalist investing emphasizes a streamlined investment strategy, typically around a few key principles that set it apart from conventional methods.

These principles include reducing the complexity of investments, focusing on long-term growth rather than short-term gains, and prioritizing sustainable and ethical investment options. By adopting this philosophy, investors are encouraged to identify what truly matters to them and invest accordingly, fostering a more meaningful and purposeful financial experience.

Principles of Minimalist Investing

Several guiding principles characterize minimalist investing. These principles provide a framework for selecting investments that not only align with financial goals but also reflect personal values and ethics.

- Concentration Over Diversification: Instead of spreading resources thin across a vast array of investments, minimalist investing advocates for a concentrated portfolio, focusing on fewer, high-quality assets.

- Simplicity: The goal is to keep the investment process straightforward. This may involve using low-cost index funds or ETFs that track the overall market rather than engaging in complex trading strategies.

- Long-Term Focus: Minimalist investors typically adopt a buy-and-hold strategy, emphasizing patience and resilience in the face of market volatility, rather than chasing quick profits.

- Ethical Considerations: Investments are selected based on their alignment with personal values, such as sustainability and social responsibility, ensuring that financial decisions resonate with the investor’s principles.

Evaluating Potential Investments

When considering investments under a minimalist framework, it is essential to evaluate each opportunity against specific criteria that reflect minimalist values. This checklist aids investors in making informed decisions:The following checklist serves as a guide for evaluating potential investments:

- Does the investment align with my personal values? Check whether the investment supports sustainable practices or social responsibility.

- What is the long-term growth potential? Assess whether the investment has shown consistent performance and growth over the years.

- Is the investment easy to understand? Ensure that the investment’s structure and strategy are clear and straightforward.

- What are the associated costs? Analyze the fees involved, including management fees and trading costs, to ascertain if they are reasonable and justified.

- How does it fit into my overall financial plan? Determine how the investment complements your other financial goals and strategies.

By employing these principles and the evaluation checklist, investors can cultivate a minimalist investment portfolio that not only reflects their financial goals but also resonates with their core values.

Creating a Minimalist Lifestyle that Supports Financial Health

Embracing a minimalist lifestyle can significantly enhance financial health by promoting intentional decision-making and reducing unnecessary expenses. Minimalism encourages individuals to focus on what truly matters, aligning their financial choices with their values. This section discusses practical lifestyle changes that can reinforce minimalism in personal finances, the relationship between decluttering possessions and improved financial decisions, and the benefits of prioritizing experiences over material possessions.

Lifestyle Changes that Reinforce Minimalism in Personal Finances

Transitioning to a minimalist lifestyle requires deliberate changes in daily habits and choices. Simple lifestyle adjustments can lead to a more streamlined financial existence. The following changes can significantly impact one’s financial well-being:

- Mindful Consumption: Adopting a conscious approach to purchasing decisions helps in evaluating needs versus wants, leading to fewer impulsive buys.

- Prioritizing Quality Over Quantity: Investing in high-quality, durable goods instead of multiple low-cost items can ultimately save money in the long run.

- Living with Less: Reducing the number of possessions allows individuals to focus on what adds value to their lives, minimizing maintenance costs and clutter.

- Emphasizing Experiences: Choosing to invest in memorable experiences rather than material goods fosters personal fulfillment and often leads to lower spending.

Decluttering Physical Possessions and Financial Decisions

Decluttering one’s physical space not only creates a more organized environment but also influences financial decision-making positively. A clear space can lead to a clearer mind, resulting in more focused financial planning. The act of decluttering can:

- Highlight Unused Assets: Identifying items that are no longer needed can lead to selling or donating them, thus generating extra cash while promoting a minimalist lifestyle.

- Reduce Maintenance Costs: Fewer possessions mean reduced upkeep, storage expenses, and overall management, translating to financial savings.

- Encourage Financial Reflection: The process of assessing what to keep or discard encourages deeper reflection on spending habits and financial priorities.

Experiences Over Possessions and Financial Well-Being

Choosing experiences over material possessions can lead to enhanced financial health and personal satisfaction. Engaging in meaningful activities rather than accumulating items often results in greater happiness and deeper connections. The advantages of prioritizing experiences include:

- Lasting Memories: Experiences typically yield more lasting joy than material items, contributing to overall well-being without the burden of maintaining physical goods.

- Social Connections: Experiences often involve interactions with others, fostering relationships that can lead to emotional support and shared financial wisdom.

- Lower Costs: Many enriching experiences, such as community events, nature outings, or cultural activities, can be low-cost or free, allowing for financial savings while enriching life.

“Invest in experiences, not possessions; they will enrich your life far more than things ever could.”

Maintaining Financial Discipline

Maintaining financial discipline is crucial for anyone looking to apply minimalist principles to their finances. It requires a steadfast commitment to simplifying financial practices and a constant awareness of one’s spending habits. By cultivating discipline, individuals can ensure that their financial actions are aligned with their goals of reducing clutter and enhancing their overall financial health.Mindfulness in spending is essential in achieving and maintaining financial discipline.

It involves being fully aware of your financial choices and understanding the impact of those choices on your overall financial landscape. Mindfulness helps individuals avoid impulsive purchases and encourages thoughtful decision-making when it comes to money management. By fostering a mindful approach, individuals can better navigate their financial journeys while adhering to minimalist values.

Techniques for Staying Committed to Minimalist Financial Practices

Developing techniques to remain committed to minimalist financial practices can have a significant impact on achieving desired financial outcomes. Implementing these strategies can help reinforce discipline and ensure that financial habits remain aligned with minimalist principles:

- Set Clear Financial Intentions: Establish specific and achievable financial goals that resonate with minimalist values. These intentions should guide your financial decisions and eliminate unnecessary expenses.

- Create a Spending Plan: Develop a detailed budget that reflects your minimalist lifestyle. This budget should prioritize essential expenses while minimizing discretionary spending.

- Track Spending Habits: Regularly monitor your expenditures to identify areas where you can cut back. This practice encourages accountability and helps in making informed financial decisions.

- Practice Gratitude: Cultivating an attitude of gratitude for what you already possess can reduce the desire for additional purchases. Recognizing the value of your current assets fosters contentment and discourages unnecessary spending.

- Establish “Cooling-Off” Periods: When tempted by non-essential purchases, implement a waiting period before making a decision. This practice allows for reflection and often results in the realization that the item is unnecessary.

Mindfulness plays a critical role in ensuring financial health. Being present and conscious of financial decisions helps individuals avoid detrimental habits that lead to debt and financial stress. It is essential to integrate mindfulness practices into daily financial routines, promoting a thoughtful approach to spending, saving, and investing.

Regular Review of Financial Habits

Conducting regular reviews of financial habits is vital for maintaining alignment with minimalist values. Establishing a financial review process can help identify areas for improvement and reinforce discipline in managing finances. The following plan Artikels how to effectively review financial habits:

- Monthly Check-Ins: Dedicate time each month to assess your budget, spending, and savings goals. Analyze any deviations from your plans and make necessary adjustments to stay on track.

- Quarterly Financial Evaluations: Every three months, perform a more comprehensive review of your financial situation. Evaluate your progress towards your financial goals, assess debts, and strategize on how to minimize expenses further.

- Annual Financial Reflection: At the end of each year, reflect on your overall financial journey. Identify successes and challenges encountered throughout the year, and set intentions for the upcoming year that reinforce minimalist practices.

- Accountability Partners: Consider partnering with someone who shares similar financial goals. Regular discussions about financial habits can foster accountability and encourage a commitment to minimalist principles.

“Financial discipline is the bridge between financial goals and financial success.”

By implementing these techniques and maintaining a mindful approach, individuals can cultivate financial discipline that is both sustainable and aligned with minimalist values.

End of Discussion

In conclusion, adopting a minimalist mindset towards finances offers a refreshing pathway to financial wellness. By prioritizing essential expenditures, simplifying goals, and reducing debt, individuals can create a more fulfilling financial journey. Moreover, as you implement these principles, you may discover that the true value lies not in accumulating wealth, but in enjoying the experiences that financial stability affords.